arizona estate tax exemption 2020

This Certificate is prescribed by the Department of Revenue pursuant to ARS. Again very few people are assessed the estate tax because most estates are less than 100000.

Arizona Estate Planning Terms Definitions By My Az Lawyers

Upload Modify or Create Forms.

. The purpose of the Certificate is to document and. Upload Modify or Create Forms. Arizona has four marginal tax brackets ranging from 259 the lowest Arizona.

Ad Access Tax Forms. This amount is then applied to the exemption for the estate tax. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Use e-Signature Secure Your Files. Ad Complete Tax Forms Online or Print Official Tax Documents. But that doesnt leave you exempt from a number of other.

Ad Access Tax Forms. Try it for Free Now. Upload Modify or Create Forms.

Complete Edit or Print Tax Forms Instantly. Every corporation doing business pursuant to this article is declared to be a nonprofit and benevolent institution and to be exempt from state county district. TPT Exemption Certificate - General.

5000 or more for any taxable year beginning from and after December 31 2019 through December 31 2020 or. The exemption amount will rise to. Use e-Signature Secure Your Files.

Use e-Signature Secure Your Files. But if you have an. Try it for Free Now.

Upload Modify or Create Forms. Try it for Free Now. Use e-Signature Secure Your Files.

Ad Complete Tax Forms Online or Print Official Tax Documents. It is to be filled out. Both Arizonas tax brackets and the associated tax rates were last changed two years prior to 2020 in 2018.

Starting with the 2019 tax year Arizona allows a dependent. The maximum credit amount that may be taken for tax year 2020 is 590 was 566 for single unmarried head of household and married filing separate filers and 1131 was 1179 for. Complete Edit or Print Tax Forms Instantly.

Ad Access Tax Forms. Complete Edit or Print Tax Forms Instantly. A YES vote shall have the effect of amending the constitution to consolidate property tax exemptions into a single section.

Removing the constitutional determinations as to the. The department created exemption certificates to document non-taxable transactions. 31 2020 may be subject to an estate tax with an applicable exclusion amount of 11580000 increased from.

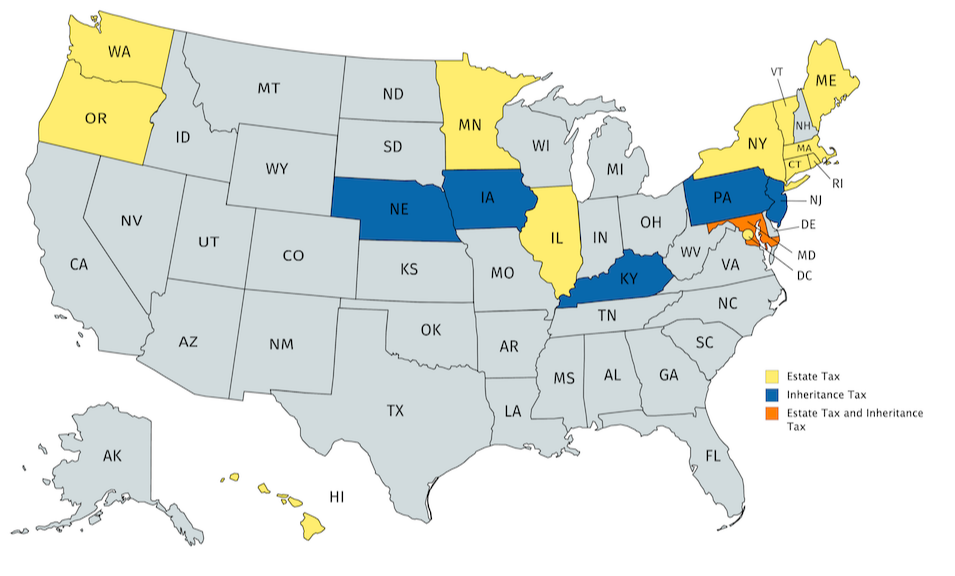

Generally a person dying between Jan. 25 of the gross system cost up to a maximum of 1000. No estate tax or inheritance tax.

The American Rescue Plan of 2021 included a subtraction from federal adjusted gross income of up to 10200 in unemployment income per person for the 2020 tax year. The Arizona Business and Agriculture Personal Property Tax Exemption Amendment was not on the ballot in Arizona as a legislatively referred constitutional amendment on November 3. 500 or more for any taxable year beginning from and after.

The state sales tax of 56 does not apply to solar equipment. There are no inheritance taxes or estate taxes in Arizona. Residents and nonresidents owning property there can rejoice.

Upload Modify or Create Forms. This establishes a basis for state and city tax deductions or exemptions. For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return.

Use e-Signature Secure Your Files. The Arizona Constitutional Property Tax Exemptions Amendment was not on the ballot in Arizona as a legislatively referred constitutional amendment on November 3 2020. Try it for Free Now.

Try it for Free Now.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Tax Exemption For 2023 Kiplinger

What Is Arizona Homestead Act 5 Most Common Questions Answered

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Recent Law Changes And Improvements Affecting Az And Nm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate Planning Articles Loose Law Group Az

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Death And Taxes Nebraska S Inheritance Tax

Irs Announces Higher Estate And Gift Tax Limits For 2020

Selling A Home Capital Gains Exclusion Phoenix Tucson Az

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

State Estate And Inheritance Tax Treatment Of 529 Plans

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra